Unemployment Insurance is a program which offers a partial wage substitute to workers who are now jobless due to no mistake of their own, while they are attempting to seek new employment. Unemployment Insurance is handled by each state but mandated by the federal law.

Click here for a 100% FREE EDD Benefits guide: EDD Benefits guide

In California, the UI program is administered by the Employment Development Department (EDD). The department itself renders decisions regarding applicant eligibility, amends rules, gathers employer taxes and issues benefit checks. The decision made by the EDD may be further reviewed by a separate state entity known as the California Unemployment Insurance Appeals Board (CUIAB). Notably, the EDD uses the EDD Debit Card to remit benefit payments to individuals.

Employers fund the entire Unemployment Insurance scheme through their tax payments. So, on behalf of every employee, each employer is required to contribute to the state UI Trust Fund. This fund is utilized to pay UI benefits to all those people who have become unemployed through no fault of their own.

This guide offers detailed information to the workers on how to collect Unemployment Insurance Benefits.

This guide is a summary of common problems and issues that arise when applying for unemployment insurance benefits. However, please be advised that this guide does not comprise all of the issues that you may encounter when attempting to obtain unemployment benefits. To obtain a more comprehensive understanding of a specific issue or unemployment insurance in general, we recommend you consult a reliable source such as the California Unemployment Insurance Code. You may also consult with an experienced and qualified lawyer, such as Crosner Legal, P.C.

This guide is specifically designed for workers who have zero experience or very little awareness of the unemployment insurance system. But, it may include certain required legal terms just to give you actual understanding. You may find this language quite similar to that which you encounter in official documents, legal sources or in an appeal hearing, etc.

Overview of Unemployment Benefits

This section provides an overview of duration, timing and amount of UI benefits.

What are Weekly Benefit Amounts?

Calculating your Weekly Benefit Amonuts

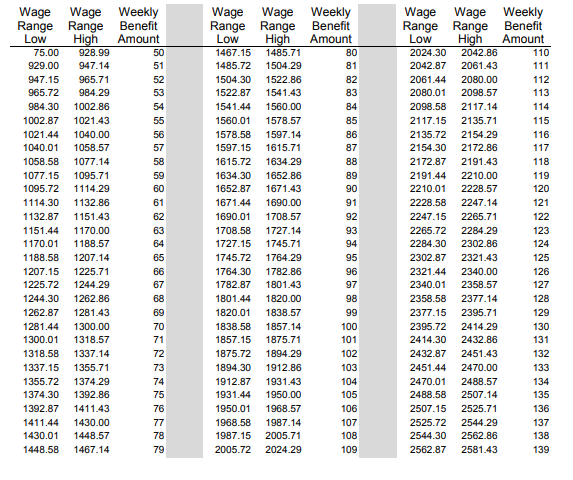

Your weekly benefit amount (WBA) is approximately 60 to 70 percent (depending on income) of wages earned 5 to 18 months prior to your claim start date up to the maximum weekly benefit amount. You may receive up to 52 weeks of Disability Insurance (DI) benefits. The daily benefit amount is calculated by dividing your weekly benefit amount by seven. The maximum benefit amount is calculated by multiplying your weekly benefit amount by 52 or adding the total wages subject to State Disability Insurance (SDI) tax paid in your base period, whichever is less.

For claims beginning on or after January 1, 2019, weekly benefits range from $50 to a maximum of $1,252. To qualify for the maximum weekly benefit amount ($1,252) you must earn at least $27,126.67 in a calendar quarter during your base period. Your weekly benefit payment amount may vary if you receive other income (such as sick leave pay, paid time off, etc.) while receiving DI benefits from the Employment Development Department (EDD).

For an estimate of your weekly benefit payment amount, you may use the tables provided by the EDD which can be found by clicking on the following links: Disability Insurance (DI) and Paid Family Leave (PFL) Weekly Benefits Amounts (DE 2588), and/or Disability Insurance (DI) and Paid Family Leave (PFL) Weekly Benefit Amounts in Dollar Increments (DE 2589).

Disability Insurance and Paid Family Leave Weekly Benefit Amounts in Dollar Increment

Important Tip: In case you have a discrepancy with the wages accounted for your base period, you may request a recalculation. Furthermore, in case of a further disagreement with recalculation, you have the right to file an appeal and present proof of wages you have earned but have not been accounted for to the EDD.

Can my unemployment benefits be reduced?

If you earn wages, whether as an independent contractor or as an employee, while collecting unemployment benefits, your benefits will be decreased by a part of the total earnings

For example:

- If you will earn below under $100 in a week, then your benefits for that particular week will be deducted by the number of wages in excess of approximately than $25.

- If you will earn greater than $100 in a week, then your benefits for that particular week will be deducted by approximately 75% of weekly wages.

Benefits are reduced for the week in which wages were earned, even if they were not paid until a later date.

Additional sources of income, such as workers compensation and pension benefits, may also decrease your weekly Unemployment Insurance benefits. To the contrary, severance pay generally does not result in any reduction.

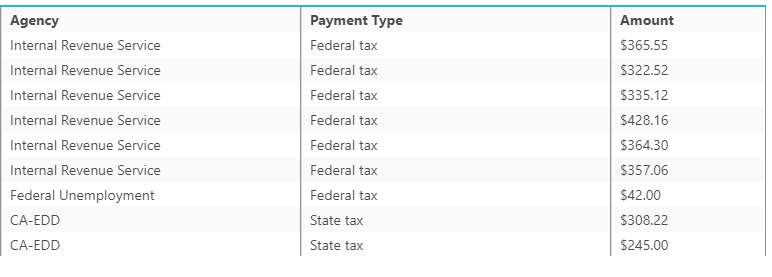

Are my unemployment benefits taxed?

In California, since Unemployment Insurance (UI) is paid entirely by employers, it is taxable income and must be reported on your federal tax return. However, it is exempt from California state income tax.

How long do unemployment benefits last?

Overview

A claim is effective for one year. During the year, claimants can receive from 12-26 weeks of full benefits. The number of weeks varies, based on total earnings during the base period (an individual’s earnings during a 12-month period).

During periods of high unemployment, additional benefits may be granted by Congress, or the State Legislature. During these periods you do not need to request a separate application for qualifying for these extensions. Rather, the EDD will automatically inform you regarding your eligibility.

Some examples of previously implemented supplementary extensions are the following:

- California Training Benefits (CTB) program: In order to be eligible for receiving up to 26 weeks of extra benefits, you have to enroll yourself in a standard job training program and file a training extension claim.

- Disaster Extension: Federal declaration can also extend the maximum benefit award to aid workers who are unemployed because of a big disaster.

- Trade Adjustment Assistance: Different workers can get federal unemployment assistance in case they are declared unemployed by the Secretary of Labor because of the rise in viable imports.

You may inquire into any offered presently offered extensions by approaching your local EDD office. A list of local EDD offices can be found by clicking on the following link: LIST OF LOCAL EDD OFFICES.

How to file a second claim for unemployment benefits

Once you finish your benefits i.e. after 26, you may no longer collect any unemployment benefits until the benefits year has completely transpired, which is typically 52 weeks after the time of your first benefits claim was filed. However, you are permitted to file a second claim for additional benefits following the completion of your 52 week benefits year so long as you can meet the standard eligibility requirements (same as in your first claim) as well as an additional “past earnings” requirement. This modified “past earnings” requires that you earn wages during the benefit year of your first claim. The purpose of this modified requirement is to ensure that you do not collect unemployment for a second claim if you have not worked or earned any compensation during the entire benefit year of your first claim.

Timing to file a claim for unemployment benefits

Your claim for benefits will be active for one year. Your benefits year commences with the date of the filing of your first claim. The claim is considered to be filed on the Sunday prior to filing your first claim for benefits. There is typically a seven-day waiting period after filing your original claim, and you will not receive any benefits during this interval. If you obtain employment and it is terminated or otherwise ends during the benefit year, you do not need to file a new claim, but rather you may simply request the EDD reopen your first claim.

How to apply and file an unemployment benefit claim

Step 1: Evaluate whether you meet the criteria to apply

You must satisfy three initial requirements to qualify for unemployment insurance benefits. However, if you are uncertain whether you meet the necessary requirements, it is strongly recommended to apply for benefits and let the EDD make an official decision.

Satisfactory Immigration Status:

Benefits can be collected by any United States citizens, workers with valid sorts of work authorization and green card holders. When you file your claim, you must have evidence to prove that you legally inhabit in the United States and are authorized to work here. Workers without complete documents are not eligible for Unemployment Insurance.

Past Earnings Requirement:

To qualify for UI benefits, you must have sufficient “past earnings” in “covered employment”. This comprises almost all types of services rendered as an employee for almost any kind of wages. Independent contractors or self-employed individuals are not generally included by the covered employment requirement.

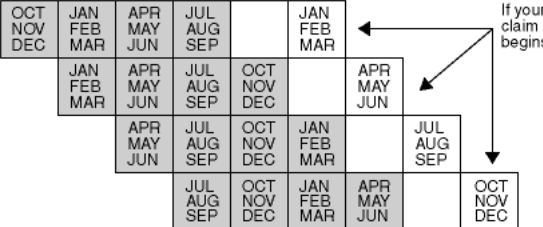

In order to determine if you meet the past earnings requirement, the EDD performs a detailed analysis of your earnings during the time period defined as your “Base Period”. The standard Base Period is the 12 month period which ended between four to six months before you filed your claim for Unemployment Insurance benefits.

| If you file your claim in… | Your Base Period is before 12 months ending in… |

| January, February or March | September |

| April, May or June | December |

| July August or September | March |

| October, November or December | June |

To qualify for the maximum weekly benefit amount ($1,252) you must earn at least $27,126.67 in a calendar quarter during your base period. Your weekly benefit payment amount may vary if you receive other income (such as sick leave pay, paid time off, etc.) while receiving DI benefits from the Employment Development Department (EDD).

The requirement of No-Fault Separation:

The third and final initial requirement is that your employment has ceased through no fault of your own. The two most ordinary examples of “no-fault” separation are the completion of the contract period or layoff for lack of work. It is noteworthy to mention that even if you initially meet all three eligibility requirements, you must further certify continued compliance with several continuing eligibility requirements, as further explained below.

Step 2: Evaluate when would be the best time for you to apply

You can file for benefits as soon as you become unemployed, and while there is no specific deadline to file your claim, it is generally advised that you apply for benefits as soon as possible. Again, your claim will become effective on the first Sunday prior to the date of the filing of your claim.

However, one outlier scenario where it may not be prudent to immediately file your unemployment claim is if your compensation (wages) had significant variations within the past 18 months before your most recent loss of employment. To further clarify, since your weekly benefits amount depends on your Base Period earnings, it can make sense to delay your claim filing until a later date if it would result in a Base Period with a larger total earnings amount. The probability of a larger weekly benefit amount should be evaluated against the downside of applying later and postponing your benefits. This tactic may not be advisable if you anticipate obtaining new employment soon or you are in need of immediate income in the form of UI benefits.

Step 3: Gather together all necessary documents and information

When applying for UI benefits you will have to provide certain information to the EDD. Below is an enumerated overview of information that you must keep ready before filing your claim for benefits:

- Claimant’s information including all names used at the workplace, residence and mailing address, telephone number, social security number, ID card number or driving license.

- Information about each employer you have worked for during the period of 18 months before filing your claim. Employer’s information includes name, wages earned, the period of employment and how you were paid.

- The exact date you worked for each employer and the number of hours you were working each week. If you were only doing part-time work, you should still inform the EDD of this part-time work and also provide them with the amount of part-time hours worked per week.

- Last employer information details such as name, physical location, mailing address, and telephone number. Ensure that you provide the right spelling of the employer’s name and address as the EDD is required to mail a notice to your last employer. Providing the wrong details won’t will likely hold up your benefit payments.

- You also have to mention the key reason for leaving your last job.

- The EDD will inquire into any additional payments from ex-employer(s) that you anticipate receiving, and in some exceptional cases may require deductions from your benefits based on these additional payments.

- Whether you are capable of being employed and available to accept any work.

- Whether you are legally authorized to work in the United States. If applicable, folks may be requested for their alien registration number.

Step 4: Submit your unemployment benefits claim application

There are two primary methods of filing a claim:

Via telephone

You may call the EDD’s toll-free number i.e. 1 (800) 300-5616 (for Spanish speakers, the phone number is 1 (800) 326-8937. The claim filing department is open between the hours of 8:00 AM & 5:00 PM Monday to Friday. Be prepared to wait on hold for long periods of time in many cases. The EDD website contains several other phone numbers for speakers of other languages as well individuals that are deaf or hard of hearing.

Via the EDD’s online portal

You can also choose to submit your claim online at https://www.edd.ca.gov/Unemployment/UI_Online.htm. This method is generally the fastest option for submitting your application as you can type your answers and submit your claim instantly.

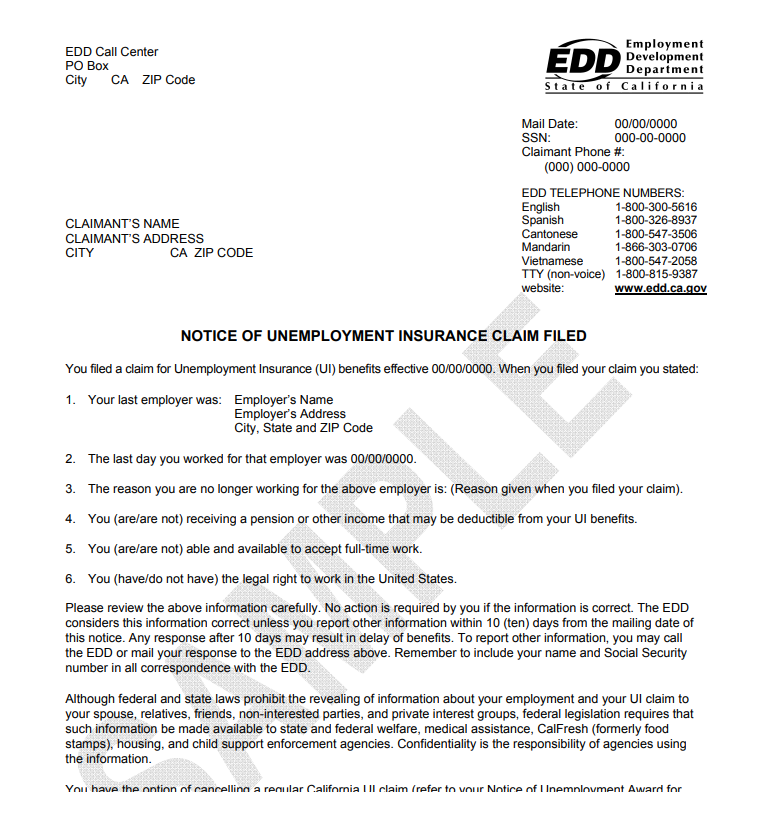

Once you submit your application whether through the internet or by phone, the EDD will mail your various documents, including:

- A Guide to Services and Benefits: This particular guide offers a normal description of the Unemployment Insurance system and employment-related services provided by the EDD.

- Notice of Unemployment Insurance Claim Filed: This notice contains pertinent informant related to your case and also substantiates that you have filed an appeal. It’s your responsibility to review the included information in detail and report to the EDD without delay if there is any error.

- Notice of Unemployment Insurance Award: This notice provides a calculation based on your past earnings and shows how much you will get in benefits if you are considered eligible. Notably, this notice does not necessarily mean you will be awarded benefits, but rather provides the amount you will receive if you are considered eligible. It is advisable to review the information contained in this notice and inform the EDD immediately if you feel anything is incorrect or inaccurate.

IMPORTANT TIP: If the wages on the foregoing notice is incorrect or inaccurate then you should directly request a “recalculation” from the EDD and submit the copies of proofs of wages earned. Inaccuracies are all too common by the EDD. They can be caused by your former employer’s failure to properly report all earnings or failure to pay all taxes owed to the EDD, or the EDD simply may have made a mistake in calculating your wages. Whatever the source, you should gather together whatever proof of increased wages earned during your employment and attempt to resolve the issue quickly. Common forms of proof to verify increased total wages may include: bank statements, work schedules, time sheets, tax records, and wage statements.

A “Notice of Unemployment Insurance Claim Filed” will also be mailed to your current employer, by the EDD. The employer will get 10 days to submit any facts which may impact your eligibility for benefits. If an employer fails to respond, he will lose the right to oppose or otherwise challenge your claim.

Step 5: Prepare for a telephonic interview with the EDD

At the start of the interview you should ask the EDD what information your former employer has provided to them so that you can invalidate any misleading or inaccurate information prospectively provided to them by your former employer.

Explain your story based on the law, not simply what seems to make the most sense to you. As an example, if you left your job due to harsh working conditions, try to explain the precise reasons why the working conditions were harsh and what actions you took to attempt to resolve the issues you faced at work and why you ultimately felt that you had no choice but to quit.

Be clear of what is being asked to you: Ask the interviewer again for the explanation when you don’t comprehend any of their questions.

Do not provide irrelevant or unnecessary information to any question and try to stay away from discussing anything outside the scope of the interviewer’s question.

Step 6: Await the EDD’s determination of your eligibility

After the telephonic interview, the EDD will render a decision based on your eligibility. It can take from 1 to 10 days.

If you are qualified for benefits, no notice will be sent to you. You will simply start receiving biweekly benefit checks with biweekly Continued Claim Forms from the EDD.

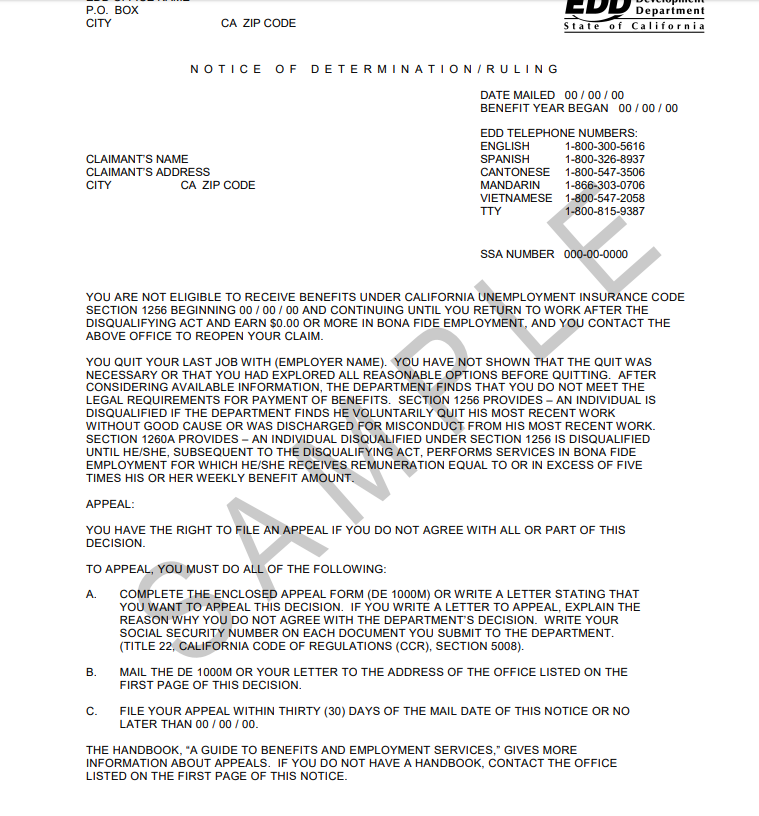

If you have not qualified for benefits, the EDD will mail you a “Notice of Ruling/Determination”. This will thoroughly illustrate two things:

- The underlying reasons for your denial

- How you can appeal their decision

This particular document comprises various legal terminologies which may be difficult to comprehend. Normally, the second or third paragraph will contain “one or two sentences” that specifically clarify the reasons why you did not qualify for the benefits. If you disagree with their rationale for denying your claim, you should highly consider appealing the decision.

How to file an appeal of an unemployment benefits claim

Step 1: Request an Appeal

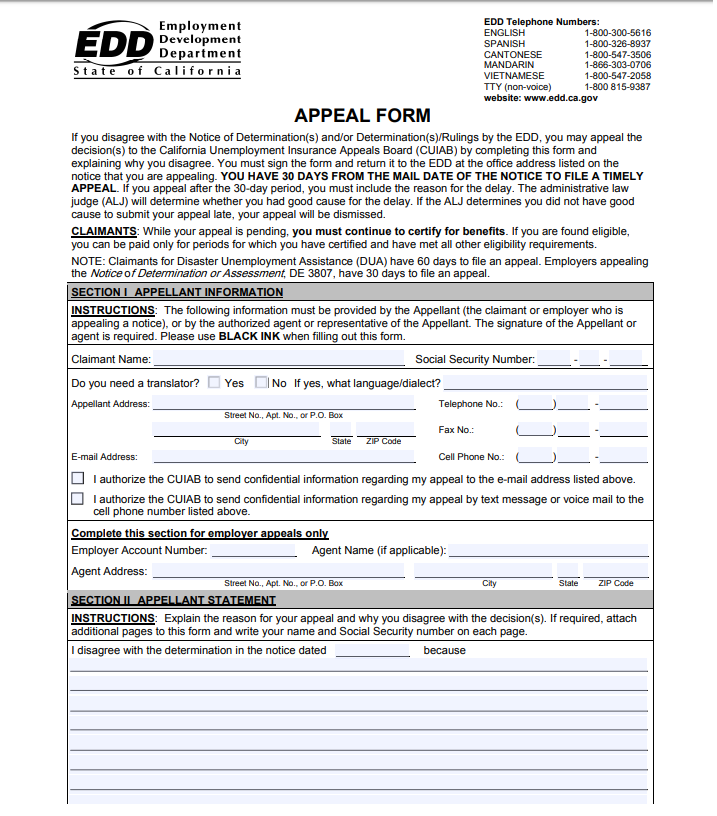

Both you and your employer have the right to file an appeal against the determination of the EDD in regards to your eligibility for benefits and/or any aspect of the EDD’s decision, such as prospective overpayments or false statements.

Deadline to file your appeal

An appeal generally must be submitted within 20 days of the mailing date of the “Notice of Determination or Ruling”. If last day i.e. 20th day falls on a holiday or weekend, then the appeal can generally be filed on the next regular business day. The appeal is considered to be filed on the date of your mailing of it. If you failed to file the appeal by the deadline you must demonstrate a strong reason for failing to comply with the deadline, such as circumstances beyond your control that you could not have practically anticipated.

Submitting an Appeal Form or Letter

Generally, the EDD sends an appeal form along with the “Notice of Ruling / Determination”. You can also obtain it from the official website of EDD, i.e. https://www.edd.ca.gov/pdf_pub_ctr/de1000m.pdf.

You may also request an appeal by simply writing a letter to the EDD stating same. The letter (and all additional written correspondences) should include your full name, Social Security Number, telephone number, and address.

IMPORTANT TIP: Whether you appeal using the letter or EDD form, you do not need to incorporate a long statement of justification why you disagree with the decision of the EDD. It is actually advised that you do not specify the underlying reasons why you disagree with the EDD’s decision because you may unintentionally make a statement which ultimately helps your employer or otherwise does not benefit your case. For this reason, the advised course of action is to simply make a one or two sentence statement essentially saying “I disagree with the EDD’s decision because the EDD made an error and I am eligible/entitled to benefits under the law.”

Notably, if you would like a translator at the hearing, you must request this within your appeal letter and also state what language translator you are requesting.

Letter of Acknowledgement of Appeal

You will receive a letter of acknowledgment showing that your appeal has been received and forwarded to an Office of Appeals. The letter will provide the phone number and location of the Office of Appeals where your hearing will be held. If your employer also submits an appeal, a similarly written acknowledgment will be sent to you too.

Submit your Continued Claim Forms while the Appeal is still pending

- If you appeal, the EDD may begin sending you the Continued Claim Forms soon after the acknowledgment of your appeal. In order to obtain benefits during the weeks you are awaiting your appeal (assuming you are successful at the appeal hearing), you must diligently fill out and send these forms back to the EDD.

- In case your employer appeals, you should not stop submitting the Continued Claim Forms. You must continue submitting these forms in the same method you were prior to the appeal.

The acknowledgment letter that is sent by the EDD will advise you that you may choose to continue receiving your benefits. However, if you ultimately lose your appeal you may be required to reimburse all the benefits that you had received from the date of the acknowledgement to the date of the final decision of the appeal. If this occurs, you will have an opportunity to challenge the reimbursement requirement by arguing that it would be unfair and overly burdensome on you.

In case you choose to stop receiving benefits during the appeals interval, and you ultimately prevail in the appeal, you will receive benefits for the interval you missed.

Notice of Hearing from the Office of Appeals

The Office of Appeals will set a specific date for the hearing which is typically 4 to 6 weeks following you or your former employer’s filing of the appeal. The Notice of Hearing will be mailed to you at least 10 days prior to the hearing date. It will comprise the following things.

- The date, time and location of the hearing

- All the legal issues that can be considered

- The name of the administrative law judge who will supervise the hearing

IMPORTANT TIP: Scheduling conflict: In case you have any critical conflict with the date of hearing, you can consider calling the Office of Appeals instantaneously. The phone number will be provided on the Notice of Hearing. The Office of Appeals does not grant continuations unless you have good cause. Good cause generally includes extenuating circumstances outside your control or urgent issues you must address such as undergoing a medical procedure on the same date.

Step 2: Prepare for the Appeal Hearing

Preparation can be the difference between winning and losing your appeal.

Make sure to thoroughly review the appeal file

The Notice of Hearing will advise you that you may arrive 15 minutes early to the appeal in order to review your appeal file. However, it is notable that you may obtain a copy of your appeal file from the Office of Appeals as soon as you receive the notice of hearing. The appeal file contains important information and will play a pivotal role at your hearing, and therefore it’s highly advised that you obtain a copy of your appeal file well in advance of the appeal in order to adequately prepare.

Your appeal file may include the following:

- Claim Notes: The EDD’s activities on the claim are reflected on the printouts of EDD computer screens. While these notes are many times difficult to understand, it is still worthwhile to brose them, particularly for any telephone conversations between the employer and the EDD.

- Employer Protest: This is the written response by the employer to the EDD’s decision notifying the employer of the claim. In case your employer elects to give this information, this will be your only opportunity to observe your employer’s written reasons for separation of your employment.

- Record of Claim Status Interview: This is generally computer-generated or handwritten notes of the interview that was conducted by the EDD with you and your employer. These notes are particularly salient if your employer did not submit any written response. This is great way to get to know your former employer’s anticipated arguments against your claim.

- Notice of Determination: Both you and your employer will get this document, which puts forth the initial benefit determination of the EDD. The language that it contains is generally boilerplate and may be difficult to comprehend. However, the initial few sentences of the second paragraph generally explicate the cause for the determination, and are therefore worth reviewing.

- Appeal Letter: The Appeal Letter includes essential information related to the challenge of the employer if he/she filed the appeal. Explore the letter to find any discrepancies between the appeal letter and the employer’s justification in the phone interview. Small variations could also raise queries on the credibility of the employer’s statements.

Research the relevant laws and statutes

Once you have reviewed the entire appeal file, you must get to know the relevant laws which apply to your case. While this guide provides a lot of the relevant laws, it’s recommended that you perform supplemental legal research or obtain advise from an experienced attorney.

The Benefit Determination Guide is an excellent source to get started with. This is a helpful handbook published by the EDD and available online at http://www.edd.ca.gov/uibdg/. It is categorized into eight volumes of various types of cases. For instance, if your appeals claim is going to deal with an allegation that you caused misconduct, you can reference Volume MC (Misconduct), or if your employer is arguing that you voluntary quit your employment, you can reference Volume VQ (Voluntary Quit).

Furthermore, the Unemployment Insurance law are set forth in various regulations, statutes, guidelines, and cases, as enumerated below:

- Statutes: The Statutes are the California Labor Code and the California Unemployment Insurance Code.

- Regulations: The CUIAB and the EDD issue certain regulations which clarify and apply the foregoing statutes These regulations are located within Title 22, Division 1 of the California Code of Regulations.

- Cases: Case decisions are maintained in the Precedent Benefit Decisions and the related rulings by the CUIAB and available online at https://www.cuiab.ca.gov/Board/precedentDecisions/index.asp.

Gather together documents as evidence to support your case

You should determine whether there is additional proof that can be incorporated into the record to strengthen your position. Some examples would be employer or coworker recommendations, performance reviews, written correspondences between you and your employer, written employer policies or memos that support your position. You may also consider obtaining declarations under penalty of perjury from coworkers or other individuals who were eye witnesses to any conduct in support of your position.

IMPORTANT TIP: It’s advisable to obtain a copy of your personnel file and payroll records from your former employer prior to your appeal hearing because it may contain fruitful evidence in support of your position or contradicting your employer’s statements. Under the California Labor Code, every employee has a right to request copies of their personnel file, payroll records, and any and all documents that were signed by the employee in relation to their employment. This typically includes disciplinary records, performance reviews, and other potentially vital documentation. A description of how to request your payroll and personnel records can be found on the Department of Industrial Relations’ website here: https://www.dir.ca.gov/dlse/FAQ_RightToInspectPersonnelFiles.htm.

Obtain witness statements under penalty of perjury (affidavits/declarations)

A witness may provide an edge to your case if it supports a crucial part of your story. You may find it particularly difficult to persuade a current employee to act as a witness and attend your hearing or even to provide a declaration in support of your claim. This is because it is common that current employees fear retaliation from their employer, notwithstanding the fact that it is unlawful for an employer to retaliate against an employee for making truthful statements as a witness. Any declaration that a witness provides should be under penalty of perjury. For example, a declaration may list the facts and then state: “l declare under penalty of perjury (under the laws of the United States of America) that the foregoing is true and correct.” This statement should be followed by the date, signature, and printed name of the person signing.”

IMPORTANT TIP: How to subpoena witnesses and documents: A subpoena is a lawful order requiring an individual to attend a hearing and/or to bring documents with them to the hearing. You have to act expeditiously if you need to issue a subpoena. The request for subpoena should be sent at least a week prior to the hearing.

For requesting a subpoena, the first step is to go to the office where the hearing will take place and fill out a “subpoena declaration”. This is a form which lists the individual and/or documents to be subpoenaed. The subpoena declaration will be reviewed by an Administrative Law Judge (ALJ) who will decide whether to sign your requested subpoena.

Upon receiving approval of your subpoena by the ALJ, you will need somebody to personally serve the subpoena on the witness. This individual will have to will out a “proof of service” and submit it to the Office of Appeals, or return it to you so you can file it with the Office of Appeals.

It’s preferred that your witness actually attend the hearing. If this is not possible you may obtain a declaration, or affidavit, from the witness which ideally will be under penalty of perjury. If you feel that your witness may not attend the hearing, despite saying so, it may be prudent to obtain the affidavit in advance in the off chance the witness fails to show up at the hearing.

Prepare a list of questions and also a closing statement

To prepare for the hearing, you should come up with a list of questions that you inquire of your former employer and of any prospective witnesses. You should focus on inquiries that buttress your position and that take into consideration the likely defenses and responses of your former employer. For instance, if your employer is claiming that you were terminated due to misconduct, but you have had only positive performance reviews, you may ask your employer about the past performance reviews. Also, if your employer has a written policy of issuing disciplinary points for misconduct and you have not received any, you may want to ask about same. While the ALJ will be the main adjudicate in the case and will therefore ask most questions, you should be prepared to follow up with your own inquiries in order to highlight any facts or information that the ALJ fails to ask about or otherwise discover.

You will also have the ability to give a closing statement. It’s advised that you prepare one in advance which anticipates the employer’s argument but also be prepared to change your approach based on what evidence was presented at the hearing. The closing statement should be no longer than 2 or 3 minutes and should simply summarize the most salient facts and evidence in support of your position and as applicable to the relevant law.

Step 3: The Hearing

Description of the unemployment hearing

- Hearing Setup: The ALJ usually organizes the hearing in a small conference hall. The ALJ will typically sit at the head of the conference table and you and any of your witnesses will be placed on one side with the employer on the other side of the table.

- Role of the ALJ: The ALJ is the trier of fact and has the authority to decide pretty much everything – who may attend, what evidence and testimony may be presented and evaluated, who may speak, the relevant and weight of evidence and testimony – and will render the ultimate decision.

- Hearing time: Hearings are generally scheduled for 45 minutes to one hour. If the hearing goes past one hour it is common that the ALJ will continue the hearing for a second session in the near future.

- Who may attend: Generally speaking you may attend and bring any witnesses. You may also bring legal representation. Your former employer may attend with or without legal representation and witnesses as well. You are not typically permitted to have a non-relevant individual, such as a friend or family member, attend the actual conference – they would have standby in the waiting room.

Important Tips

- Try to arrive before the scheduled time: It’s advised that you arrive at the hearing at least 30 minutes early. During this time, you can review your appeal file to check whether any documents have been added such as a internal company documents or other documentation left out of your request for production of your personnel file. The ALJ may also dismiss the case if a party who filed the appeal fails to appear in a timely manner or does not show up at all.

- Dress appropriately: As the saying goes, dress for success. We recommend you dress neatly in business attire, or at the very least business-casual attire. Moreover, do not wear any clothing with inappropriate language, designs or otherwise may show a lack of respect for the ALJ or the process.

How the unemployment hearing generally commences

The proceedings are generally recorded by the ALJ. He or she will also ask if anyone has any concerns or questions and explain the issues of the case, including applicable law. After this, the ALJ will go through each of the documents included in the appeal file requesting if there is any objection to including them into the record. The ALJ will also swear-in the witnesses and parties. Witnesses will be asked to remain in the waiting room or outside of the conference room until it is time for them to be heard.

Most of the questioning by the ALJ is generally done during the hearing. He also decides which party he or she will question first. In the “misconduct” related cases, the ALJ will typically first question the employer whereas in “voluntary quit” case, an employee is generally asked first.

How to present your testimony at an unemployment hearing

To obtain the facts required to make any decision regarding the case, the ALJ will typically ask you a number of questions. After this, your employer will be allowed to ask follow-up questions, if any. There are certain things one must keep in mind while answering questions from the employer or the ALJ.

- Give an appropriate answer to the asked question: You can and should take a moment (i.e pause) to think about your response prior to actually answering. You want to fully understand the question, and the scope of the question, prior to responding.

- Ask the ALJ again for clarification prior to responding to any question that is unclear to you: Misunderstanding the query may result in you to providing an incorrect answer, which would likely negatively impact your credibility in the ALJ’s eyes.

- Answer in an honest and respectful manner: Because the ALJ has complete authority to make the ultimate decision you want to treat him or her with paramount respect and try your best to project a deferential demeanor and to come off as honest and polite. One tip is to refer to the ALJ as either “Your honor” or “Judge”. For example, when the ALJ provides you with instructions, you can respond “Thank you, your honor.”

- Don’t talk too much: As previously mentioned, you want to limit your response to only providing necessary information within the scope of the question. Your initial instinct might be to provide more information and as many events as possible. In most cases, this is not beneficial – answer the ALJ’s questions succinctly and if anything, err towards the proverb that “less is more.”

- Don’t Get Angry: As frustrated as you might be, you want to concentrate on telling your side of the story in a thoughtful, respectful manner, even if you feel the employer is lying. Making accusatory, hostile or sarcastic statements will not typically help your cause, but rather may create an impression that you are overly emotional.

How to present your supporting documents

While presenting your case in front of the Judge, you can consider submitting appropriate documents such as recommendation letters or positive reviews from the employer. You should also take a minimum of three copies of any documents you intend on presenting so that you can also submit them – one for the employer, one for the ALJ and one for personal use.

How to present your witnesses for questioning

Taking a witness to provide live testimony at the hearing is generally a better option than providing an affidavit in support of your case. As previously explained, witnesses can subpoenaed to be present at the hearing. Generally, the witness will be questioned by the ALJ and the employer will also have an opportunity to follow up with additional inquiries.

Your Employer’s Arguments

The employer will present his/her case in the same manner that you present your case. He or she will also be required to respond to the questions from the ALJ and may also present documents and witnesses to testify. You will have the opportunity to ask follow-up questions from the employer or his or her witnesses.

The Closing Statements

It is the ALJ’s choice whether he/she wants to give a few minutes to both parties to present closing statements at the end of the hearing. If you wrote a closing statement prior to the hearing, make sure to consider changing the statement to address any new/different evidence or arguments presented.

Concluding the Hearing

Once both parties present their cases and all appropriate evidence, the ALJ will typically finish the hearing by asking both parties if there are any additional questions. If not, the hearing will be concluded by the ALJ. He/she will also inform the parties when they can expect the final decision.

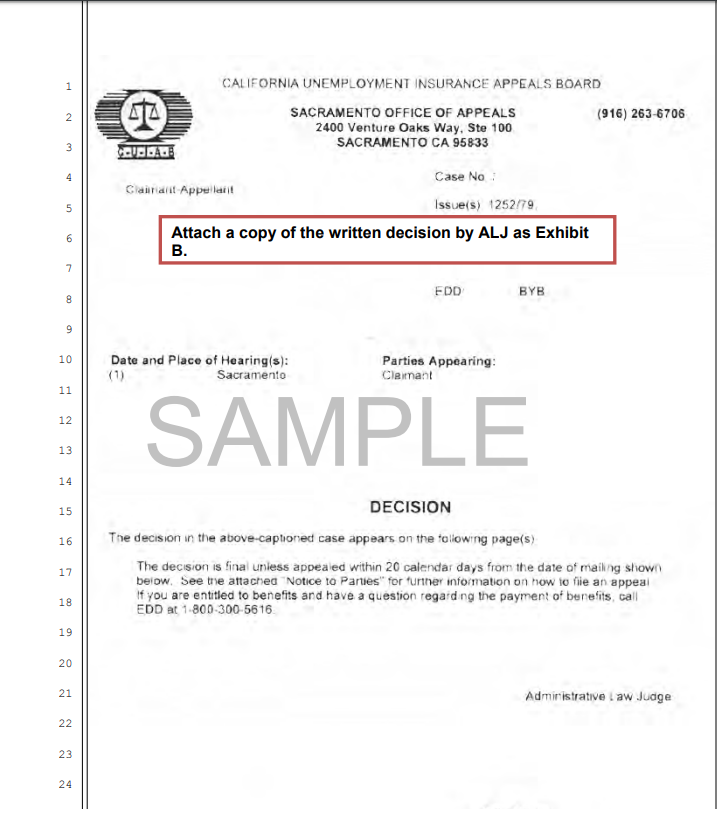

ALJ Decision

You typically receive the ALJ’s decision by mail within no longer than three weeks. If a month has transpired without receiving the decision, it’s advised that you contact the Office of Appeals to request an explanation for the delay.

The ALJ will explain the facts/law that he or she relied on and the various reasons for reaching the final decision. If you do not agree with the decision you can further appeal to the California Unemployment Insurance Appeal Board.

Step 4: More Appeals?

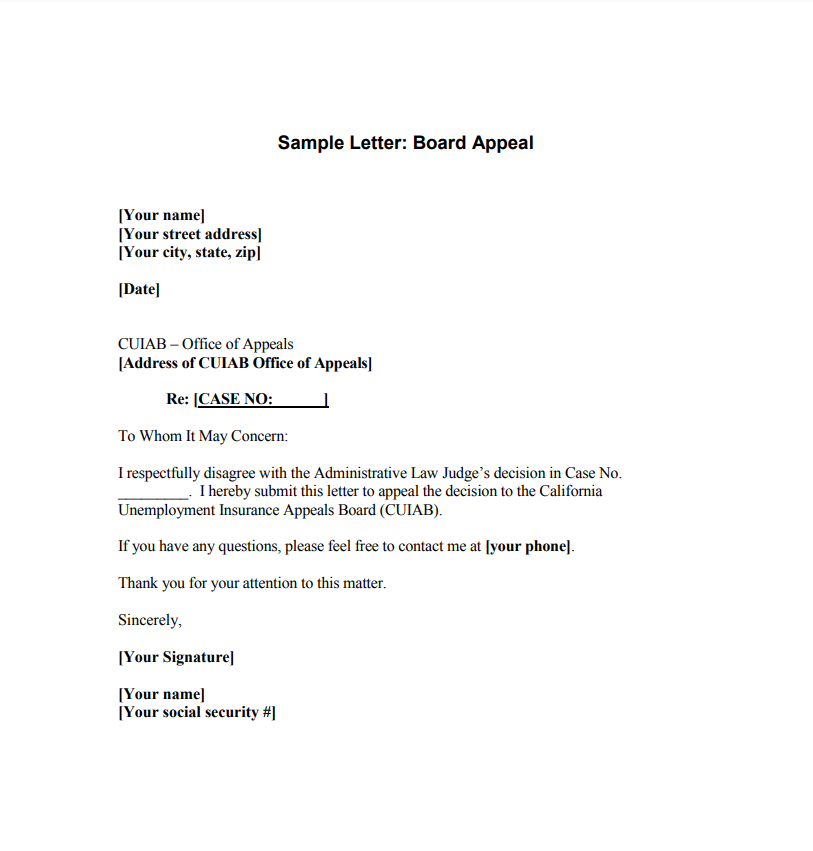

File a Board Appeal

If you disagree with the decision of the ALJ, you will have 20 calendar days from the date of the decision to file an appeal with the CUIAB in Sacramento. The date of the decision is generally specified on the first page of the decision.

The appeal must be in written format and does not need to include long statements on why you disagree with the final decision by the ALJ. Your letter should briefly state that you are requesting an appeal of the ALJ’s decision because you believe it is incorrect, and it should give your address, name, social security number, phone number and the case number associated with unemployment benefits. Don’t forget to sign and date the letter and mail it to the Office of Appeals where your case was held.

IMPORTANT TIP: Filing documents with the CUIAB: Each document filed with the CUIAB should be “served” through the mail, on the opposing party (i.e your former employer). The original document should be mailed to the CUIAB and postmarked by the particular date. With every filing you must comprise a proof of service to substantiate that the opposing party was appropriately served.

Acknowledgement of Appeal

You will receive a letter acknowledging receipt of your appeal from the Office of Appeals. This letter will contain your CUIAB case number and will provide further procedural instructions for you to follow. This same letter would be provided to your former employer if he or she filed the appeal.

Request a Copy of the Record

You may request a copy of the record of your hearing any time prior to 12 days after the mailing of the appeal acknowledgment letter. The record will likely include a copy of the recording from the hearing or a written transcript. You will not be charged for the copy of the records.

Written Argument

Written arguments may also be submitted any time prior to 12 days after the mailing of the appeal acknowledgment letter. The written argument should outline the facts related to the case, all legal arguments, and clarify with supporting reasoning how the decision rendered by the ALJ was incorrect. While the written argument is not compulsory, it provides an opportunity to explain why the decision should be overturned. For this reason, it is highly advised that you draft and present a written argument with your appeal.

Additional Evidence

Generally, you are not permitted to include additional evidence unless for some good cause reason the evidence was not heard at the initial hearing. If you want to submit documents or affidavits that you were unable to present at the hearing then you must request permission on or prior to the date specified in the letter acknowledging the appeal.

Standard of Review

Two of the seven members of the CUIAB will be randomly selected to handle the appeal. These two members will review the record and evidence and decide whether to overturn the ALJ’s decision. If the two member are unable to obtain a unanimous decision, a third member will be included at that time to decide based on majority quorum.

Board’s Decision

Within 60 days of the submission of the appeal, a written decision will be issued by the Board panel.

Notably, the Board panel’s decision may be further appealed to the California Superior Court. The Superior Court appeal must be filed within six months following the date of the mailing of the CUIAB decision. The Superior Court would also perform a review of the record in order to decide whether

The decision of the CUIAB in Sacramento can be further appealed to the superior court. But, this appeal must be filed within the next six months from the date of mailing of the CUIAB decision. In the majority of the cases, you can approach the court only after carrying out the administrative procedure including CUIAB and the ALJ hearings.

The superior court will also review the administrative record, but to decide whether the decision-making process and ultimate decision was the result of prejudicial abuse of discretion, or on the other hand, it was a fair trial where you were fairly afforded your due process rights.

An Abbreviated Timeline of the Complete Appeals Process

- Date of ALC decision (20 days)

- Simple appeal must be submitted (time for CUIAB process appeal)

- Acknowledgement letter sent by CUIAB (12 days)

- Request for record of hearing must be submitted (time for CUIAB to process request and send record)

- Hearing record sent by CUIAB (12 days)

- Full appeal arguments must be submitted

Common Appeals: Voluntary Quits and Misconduct

Unemployment Insurance offers benefits to workers whose employment ended through no fault of their own. There are three general terms used in the unemployment context to illustrate how your employment ceased – via “discharge”, “quitting”, or a “lay-off”. It is important to know the differences between these terms because it will determine whether you meet the eligibility requirements to obtain benefits.

- Lay-Off (Lack of Work): A Lay-off occurs when you are unable to continue with the job because your position or job duties have been removed and no additional job duties/position was provided by the company. You are typically eligible for benefits when you have been laid-off.

- Quit (i.e. “Resignation”): The term “quit” is defined as the employee’s rejection to continue with his or her employment despite the employer maintaining a position and/or job duties for him or her. Generally, you are not permitted to obtain unemployment benefits if you quit your employment unless it was for “good cause,” as described below.

- Discharge (“Terminated” or “Fired”): Discharge is defined as your employer’s refusal to let you continue the job notwithstanding the fact that work remained available. If you were discharged then you are generally eligible for benefits except when your employer can prove that the reason for the termination was based on your misconduct, as described below.

Did you Voluntarily Quit without Good Cause?

If you quit your job, then you will be eligible for the benefits only if you can justify that you took reasonable steps to resolve the issues at work, or in the alternative, you quit for “good cause.”

“Good Cause”

This means you had persuasive reason(s) which forced you to leave your employment despite the fact that you desired to continue working. “Good cause” may include compelling personal reasons (i.e. care-taking of a close family member, pregnancy/maternity; relocation; or domestic violence), or “good cause” may be work-related (i.e. harassment, hostile work environment, unsafe working conditions, discrimination, fraud, or retaliation). Some examples of reasons that likely would not meet the criteria of “good cause” are: unhappiness with a change in your work schedule; a belief that you are overqualified for your job position; not receiving a promotion for any reasons other than discrimination; or a non-discriminatory reduction in hours.

“Reasonable Steps to Resolve the Issue”

This is generally interpreted to mean that you attempted to discuss the issue(s) with your former employer at least on one occasion and he or she did not provide any reasonable opportunity to resolve the issue(s).

IMPORTANT TIP: The primary focus on your claim and arguments at the hearing should be proving that you had “good cause” to end your employment, while simultaneously expressing any and all actions taken to continue with your employment. It is advised that you prepare a written statement describing the specific events which resulted in your ultimate decision to quit, and any and all actions taken by you to reasonably preserve your employment. Some examples of actions taken to preserve your employment may be: requesting time off from work, providing doctor’s notes, communications with HR or supervisor (i.e. text messages and/or emails), etc.

Were You Terminated Because You Committed Misconduct?

As previously explained, individuals terminated for work-related misconduct are not entitled to benefits. To prove misconduct, your employer must prove the following 4 elements:

A Material Duty That You Owe to the Boss

“Material duty” is a duty that is inherently incorporated into the job position. For example, a retail salesperson has a material duty to sell the employer’s products or services, but the salesperson likely does not have a material duty to walk the owner’s dog.

A Substantial Violation of That Duty

“Substantial” means that the employee’s actions were more than a small deviation from the usual or reasonable course of actions. For example, leaving work a few minutes early would not likely rise to the level of substantial, but departing from work several hours before your schedule ends may be considered substantial, particularly if it is a repeated behavior and/or there have been warnings.

A Violation Which Indicates Wanton or Willful Disregard for the Duty

This means that you committed the violation either intentionally, knowingly, or with reckless disregard of the company’s policies and the resulting consequences.

A Violation Which Tends to Spoil the Business Interests of the Employer

This is more of a case by case analysis of the nature of the business and the circumstances surrounding the violation. Some examples may be causing the company to lose a customer due to the violation, disrupting the business operations which resulted in the company losing money, or causing the quality of the product or service to be reduced in some fashion.

The ALJ must decide whether the employer has met all four of the foregoing elements. In order to prevail against your employer, it is advised that you attempt to attack each or as many of these four elements as you can. Some examples would be arguing that the violation does not meet the wanton or willful element because no material damage or harm (i.e. company did not lose money, customers or product) was caused to the business by your actions.

In addition to attacking each of the elements of misconduct, you should also consider asserting specific defenses that have been recognized by earlier CUIAB decisions, such as any of the following.

Poor Performance Defense

In this defense you would allege that your poor performance was not intentional or done with reckless disregard, but rather was just an inability to meet your employer’s desired standards. This defense may not prevail, however, if your employer characterizes your work product as consistently far below a reasonable standard or care, or had dropped to that level leading up to the date of the termination.

Isolated Incident Defense

This defense may be asserted when the termination was a result of a first-time offense, particularly when it is the result of conduct that was no in line with your previous actions, or was caused by a brief lapse in good judgment. For example, if you had achieved several positive reviews for your ability to work with customers in a polite and honest demeanor, and you were fired due to one client characterizing you as rude, this defense is likely worth asserting.

Casual Connection Defense

The employer was show a direct causal correlation between your termination and the misconduct they are alleging caused the termination. If you believe and have supporting evidence indicating that the employer’s alleged reasoning is really just pre-text, and you were actually terminated for a different reason that was unrelated to misconduct, you should assert this defense. An example would be if your employer alleged that you were terminated for arguing with a customer, but you can show that this was the first argument you ever had with a customer and the real reason you were terminated was because you had reported the company to OSHA for unsafe working conditions. Notably, the close proximity in time between the reporting to OSHA to the time of termination would be strong evidence in your favor.

Employer Condones Behavior Defense

This defense should be asserted if you have evidence that your employer has permitted others to remain employed for the same actions that he or she is claiming as the misconduct, or the employer has not disciplined or warned you in the past despite you taking the same actions that they are alleging were the misconduct.

Continuing Eligibility Requirements

Once you have been granted eligibility to receive benefits by the EDD, you must then meet certain criteria in order to continue your eligibility. The criteria includes: (1) being mentally and physically able to perform work in your vocation; (2) remaining underemployed or unemployed; (3) be actively looking for new work; (4) complying with the reporting requirements of the EDD by submitting bi weekly Continued Claim Forms; (5) being immediately available for appropriate work in a suitable field of employment. Failure in meeting any of these requirements may lead to penalties, disqualification and even the repayment of benefits.

Able to Work

Being “able to work” means that you are mentally and physically prepared to do work in a position that meets your vocational training or skills.

If you have a disability (i.e. injury or illness) which requires an accommodation in order to continue working (i.e. restrictions on sitting for too long or lifting more than a certain weight), you may still be able to meet this requirement.

However, if your disability completely prevents you from seeking employment for one or more work days in a work week, then you must state this on your Continued Claim Form and your weekly benefit will likely reflect a reduced amount based thereon. In the alternative, if your disability does not permit you to work for over a week, then you should highly consider filing a claim with the EDD for temporary (or possibly permanent) State Disability Insurance benefits. Once you are able to work, at least part time, you can re-initiate your unemployment insurance claim.

Underemployed and Unemployed

UI only permits you to receive benefits if you are earning less than 1.33 times your weekly benefit amount. If you are earning some income, but not as much as 1.33 times your WBA, then you must state same on your Continued Claim Form and your WBA will likely be reduced accordingly.

Available for Work

This means that you are immediately available to accept work in your vocational field. While you are afforded a presumption of availability for work, the EDD could find that you do not meet this requirement if it is made aware that you are turning down employment or substantially limiting your employment search without having good reason to do so. Some examples of actions that may result in disqualification include: restricting your employment search to part-time work for no good reason (assuming you were full time in your last position), restricting it to an unreasonable small geographic area; starting school instead of seeking employment; becoming incarcerated; becoming a full time caretaker, etc.

Comply with the EDD’s Reporting Requirements

Continued Claim Forms

You are required to submit a Continued Claim Form to the EDD every two weeks beginning with specific date of your claim filing.

If you do not succeed in submitting the form, you will not get benefits for the period of that particular two-week period unless you provide good cause (a compelling reason) which prohibited you from filing the claim by the deadline. Simply forgetting to fill out or submit the form generally will not rise to the level of good cause for delay. In the alternative, a medical procedure that forced you to be in the hospital for a period of time likely would qualify as good cause.

You must provide responses to all questions on the Continued Claim Form. You also have to provide the details of any income earned during the two-week period, even if you have not been paid the actual compensation during this period. If you do not understand any questions, you should contact the EDD to speak with someone who can assist you, or you can consult with an attorney who is experienced in handling these types of matters.

Job Search Workshops

The EDD may also ask you to attend an Initial Assistance Workshop help educate you on how to obtain new employment. It’s advised to attend the workshop even if you do not believe it will be a valuable learning experience. This is because failure to attend may cause a one-week disqualification of receipt of your benefits.

Penalties, Overpayments, and Disqualifications

There are a multitude of reasons that you may be disqualified from receiving benefits, or why your benefits may be delayed during certain intervals. It may also be determined by the EDD that you must pay a penalty or return a portion of the benefits previously paid to you. Below is a list of common mistakes and sources of penalties, overpayments and/or disqualifications.

Failure to Meet Continuing Eligibility Requirements

If the EDD determines that you did not meet any of the continuing eligibility requirements, then you will likely be disqualified from receiving further benefits. The most common reason for disqualifications is a failure to meet the “available” and “able” criteria.

Notably, if you believe that the reason cited for your disqualification are inaccurate, you have the right to appeal your disqualification. Alternatively, if you believe that you no longer should be disqualified because you now meet the criteria, you have the right to apply to the EDD for the resumption of your benefits.

If your disqualification is based on a refusal of employment without good cause, you may reapply for benefits following a 2 to 10 week disqualification period, which will be provided to you by the EDD. The duration of your disqualification period is an appealable issue and can be reduced. The disqualification penalty does not result in a reduction of your weekly benefits amount, but rather just places a hold on payment during the disqualification period.

Appealing Your Disqualification

As stated, you have the right to appeal your disqualification. You may do this by submitting the appeals form providing by the EDD, or by writing a letter to the EDD briefly and succinctly stating your disagreement with their decision and desire to appeal it. The appeal submission or letter must be provided within 20 days following the date of the mailing of the Notice of Disqualification.

If you are attempting to appeal an EDD finding that you were not “able” or “available” for work, you should attempt to describe why the restrictions you placed on your employment search are trivial and do not significantly impact your ability to obtain suitable employment.

Overpayments

This occurs when you were paid benefits in an amount that the EDD determines you were not qualified to receive. In most cases, the EDD will endeavor to recuperate the overpaid benefits and may also impose penalties. There are several reasons for a potential overpayment. Some common reasons for overpayment include:

- Overpayments as a Result of False Statements: as a result the applicant employee putting forth statements that are determined by the EDD to be false. In this case, the EDD will typically impose one of three types of penalties: (1) the EDD will require you pay back any benefits received that were paid as a result of the false statement; (2) the EDD will implement a penalty equal to 30% of the overpaid benefits; or (3) the EDD will disqualify for benefits for a period of 5 to 10 weeks. Under the latter scenario, the length of the disqualification is typically related to the gravity and amount of false statements determined to be made.

- Overpayments Due to Loss on Appeal: occurs when an employee chooses to obtain benefits during the time period when his or her employer is appealing the EDD’s initial approval of the claim. If your employer prevails on appeal, you may be required to repay all benefits received between the date the appeal was filed through the date of the final decision of the appeal.

- Overpayments Due to the EDD’s Mistake: In certain circumstances, an overpayment is the outcome of error committed by the EDD. Nevertheless, the EDD can require you repay the benefits received as a result of their error.

Avoiding Repayment through Waiver or Appeal

If you are required to repay benefits but are unable to afford to repay the benefits owed in one lump sum amount, you may put forth a request to the EDD for installment payments. You may also attempt to request that the EDD waive the entirety of the repayment if you are financially incapable of repaying any amount. In order to qualify for this waiver, you must fill out the EDD’s form and describe your lack of financial capabilities. Notably, if your waiver is denied you may formally ask for a hearing with the ALJ, which serves as a de facto appeal of the waiver. The criteria for prevailing on the appeal is the same as a typical appeal of the EDD’s decision.

In order to prevail against an EDD decision in favor of overpayment, it’s advised that you attempt to prove the following:

- That you did not make a false statement: If you are able to prove that your alleged misrepresentation did not actually result in any overpayment, this alone could save you a 30% or more penalty.

- The overpayment was not your mistake: You did not cause the overpayment but rather simply relied in good faith on the information provided by the EDD.

- Repayment would be an unfair burden and confiscatory: You should do your best to show that repayment would cause significant and unfair hardship on you, and as a result would be in direct conflict with the public policy and objectives of the unemployment insurance program. You should put forth information describing your prospectively adverse financial condition, including any outstanding debts that would likely be caused by the imposition of the repayment, such as inability to pay rent or car payment, outstanding loans or debts, etc.

Common Occurrences For Employees in California – You May Be Entitled To Further Compensation

Did you know that many unemployed people may have suffered from labor violations such as wrongful termination, workplace discrimination, unpaid overtime, unpaid wages, missing breaks, and other labor violations during their last employment? We know that you are here for different information, but we also want you to know that you MAY be entitled to compensation due to labor violations during your last employment.

If you feel like you were wrongfully terminated then please don’t hesitate to schedule a 100% FREE consultation or click HERE.

If you feel like you were discriminated against in the workplace then please don’t hesitate to schedule a 100% FREE consultation or click HERE.

If you feel like you are owed unpaid wages from a previous employer then please don’t hesitate to schedule a 100% FREE consultation or click HERE.